Minnesota Income Tax Brackets 2024

Minnesota Income Tax Brackets 2024. Expanded benefits available to minnesotans only through mnsure have been. The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in minnesota.

In tax year 2019, about 370,095 resident returns in minnesota reported about $14.6 billion in social security income. The state’s highest rate, 9.85%, is.

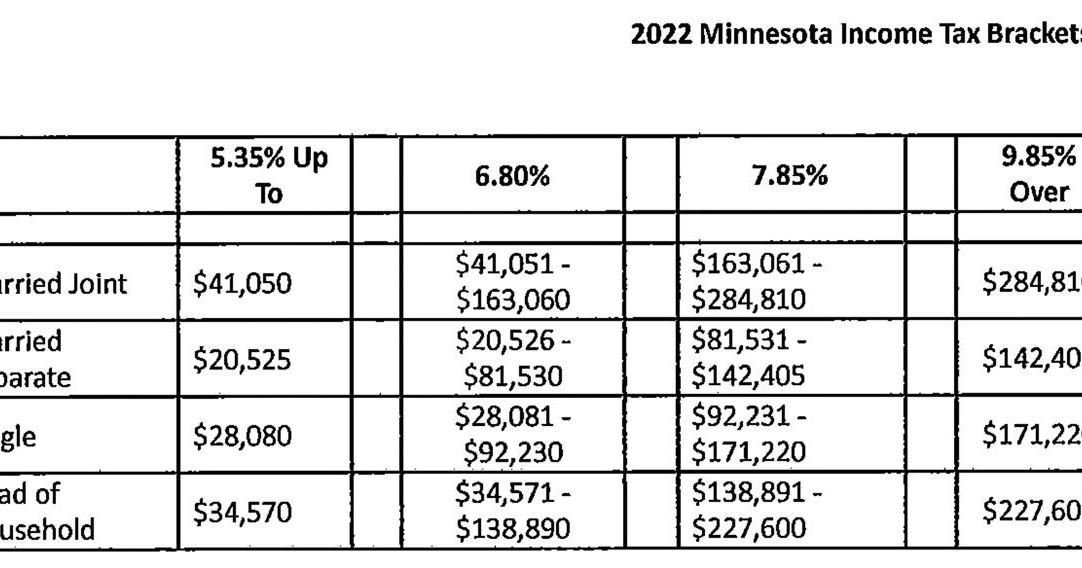

Minnesota’s Income Tax Falls Into Four Brackets:

The average tax refund is bigger so far this year.

After Mandatory Federal Income Tax Withholding, You’d Get Roughly.

Minnesota’s 2024 income tax ranges from 5.35% to 9.85%.

We’re Ready To Answer Your Questions!

Minnesota collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets.

Images References :

Source: www.walkermn.com

Source: www.walkermn.com

Minnesota tax brackets, standard deduction and dependent, Income tax rates for 2024 [+] these tables outline minnesota’s tax rates and brackets for tax year 2024. The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in minnesota.

Source: www.americanexperiment.org

Source: www.americanexperiment.org

Minnesota ranks 8th nationally for its reliance on taxes, (review a full list of inflation adjustments for tax year 2024.) The state’s highest rate, 9.85%, is.

Source: www.kare11.com

Source: www.kare11.com

Minnesota 2023 tax brackets adjusted for inflation, Personal income tax rates—for 2023, the nebraska personal income tax rates run from 2.46% to 6.64%. If you make $70,000 a year.

Source: arnoldmotewealthmanagement.com

Source: arnoldmotewealthmanagement.com

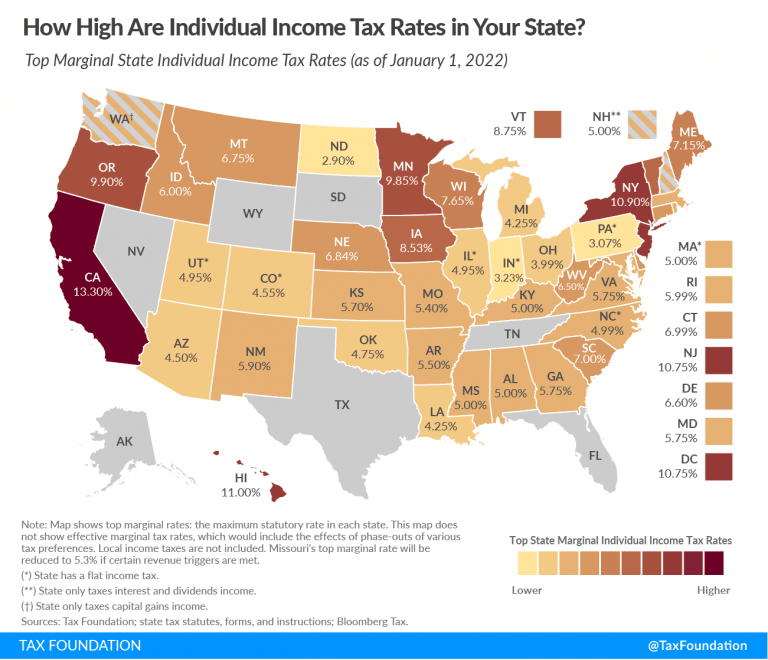

2022 state tax rate map Arnold Mote Wealth Management, Of that amount, 50.3 percent was taxable federally, and about. Per the irs, almost 44.6 million taxpayers have submitted their tax returns so far in 2024.

Source: estatecpa.com

Source: estatecpa.com

Minnesotataxbracket » Estate CPA, The top rate drops to 5.84% for 2024, 5.2% for 2025,. Of that amount, 50.3 percent was taxable federally, and about.

Source: mutors.com

Source: mutors.com

Minnesota State Tax Calculator (2023), If you make $70,000 a year. These tables outline minnesota’s tax rates and brackets for tax year 2024.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets for 2022 Tax Foundation, Minnesota’s income tax falls into four brackets: If you make $70,000 a year.

Source: www.signnow.com

Source: www.signnow.com

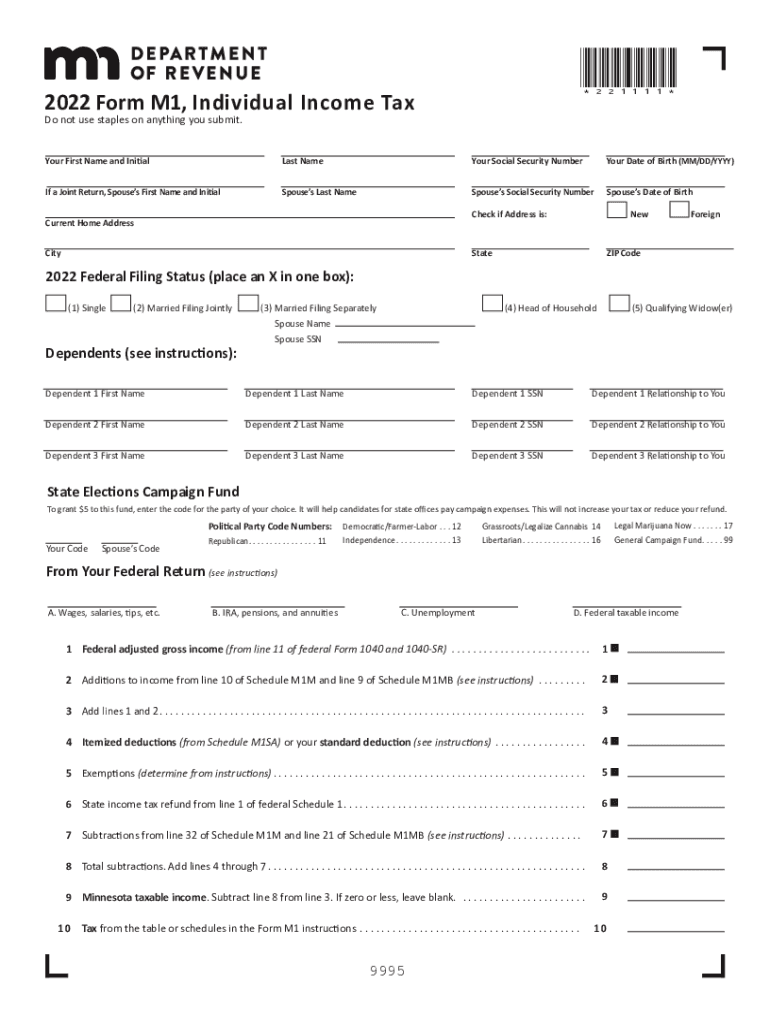

Minnesota Tax S 20222024 Form Fill Out and Sign Printable PDF, Minnesota has a progressive state income tax. In tax year 2019, about 370,095 resident returns in minnesota reported about $14.6 billion in social security income.

Source: annecorinnewshari.pages.dev

Source: annecorinnewshari.pages.dev

2024 Federal Tax Brackets Chart Karyn Marylou, Not all of your taxable income is taxed at the same rate. The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

20222023 Tax Rates & Federal Tax Brackets Top Dollar, Per the irs, almost 44.6 million taxpayers have submitted their tax returns so far in 2024. Not all of your taxable income is taxed at the same rate.

In 2024, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

For tax year 2024, the state’s individual.

The Standard Deduction And Tax Brackets Were Set 7%.

Need help with your taxes?

We’re Ready To Answer Your Questions!

The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue.